If you are a sports bettor, you want to send and receive your funds quickly and pay as little as possible when it comes to transaction fees (check Crypto sports betting sites for additional information). Peer-to-peer transfer applications have done little to solve this issue. Checks take a week, bank transfers take days, and wire transfer takes up to 24 hours to process transactions.

Waiting for weeks, days, or even hours to deposit funds to your sportsbook account or receive your winnings is frustrating. That is why many individuals are shifting to cryptocurrencies and crypto-friendly banks and financial institutions.

With these banks, institutions, and digital assets, you can transfer your funds immediately and settle balances without having to wait for a week, days, or hours to clear.

However, most traditional banks still resist cryptocurrency adoption. On the other hand, a few banks allow you to add cryptocurrency to your portfolio. These banks offer all the benefits of traditional banking services, including direct deposits, funds and interest insurance, and all other perks that digital assets provide.

People are asking these questions

⭐ Which banks support Cryptocurrency?

Some of the best banks for cryptocurrency include:

- Revolut

- Bankera

- Monzo

- Barclays

- Coinbase

- Robinhood

⭐ What Makes a Bank Crypto-Friendly?

For a bank to be considered crypto-friendly, it must provide some support for cryptocurrency assets and activities. Crypto friendly bank allows customers to open accounts to buy, sell, and trade cryptocurrency or offer secure storage for crypto-assets. Additionally, the bank must provide services facilitating crypto-transactions, such as payment processing and foreign exchange services.

⭐ Do banks accept Bitcoin?

✅ There are banks that are Bitcoin-friendly and permit the use of cryptocurrency services, including Bitcoin, by individuals and companies. Additionally, some financial institutions accept funds obtained from cryptocurrency transactions.

⭐ How banks can benefit from Cryptocurrency?

Blockchain technology can benefit banks in several ways, such as streamlining processes, reducing costs, improving security, and increasing transparency. Cryptocurrencies can help banks appeal to previously underserved populations, including those without access to traditional financial services.

⭐ What is the future of blockchain in banking?

Banks can utilize blockchain technology to enhance their services and improve customer experience. Moreover, implementing blockchain can help banks cut down transaction expenses and mitigate risks by updating records across several systems.

So what are Crypto Friendly Banks? Crypto-friendly banks are institutions that offer traditional banking services as well as cryptocurrency offerings. Getting payments from a conventional bank account to crypto meant jumping the old-fashioned payment rails to modern ones.

But currently, many cards and bank accounts work alongside cryptocurrency exchanges. This provides room for some great opportunities, including easy and quick access to web3, NFTs, and DeFi, lower transaction fees, and faster fund transfers. Let’s dive deep into the world of best crypto friendly banks and sports betting to discover more.

Also, read our guide on how to bet with Crypto.

Why do Bookmakers Block Visa and MasterCard Payments?

Even though cards like Visa and MasterCard allow you to add funds to an online sportsbook account, it is also common to see them blocked or declined. Credit card deposits for sports betting are blocked more than any other payment method.

Unlike many other situations where a card is blocked or declined, this may not always have to do with exceeding credit limits or fraud alerts. Instead, it is typically because the credit card provider or the bookmaker prohibits the use. Most credit card providers don’t consider sports betting or gambling an acceptable purchase; some see it as risky.

This’s mostly because some banks or financial institutions are worried about inadvertently facilitating illegal behaviour and activities and facing legal consequences, even in countries where sports betting is allowed.

These are some of the reasons why bookmakers block or don’t accept Visa and MasterCard payments. The best alternative to Visa and MasterCard is cryptocurrency.

What Makes a Bank Crypto-Friendly?

Since introducing blockchain technology and tokens into the financial space, some banking institutions have adopted them into their daily operations to serve their customers better.

These banks serve as upgrades from the traditional centralised banks and operate excellently. They allow their customers to make transactions using crypto tokens and fiat currency.

Cryptocurrency-friendly banks offer services for customers to purchase, hold, sell and save digital assets alongside their traditional bank accounts.

Crypto-friendly banks’ cryptocurrency segment functions quite uniquely from other sections based on blockchain technology. That means the digital assets aren’t under control or regulation by a centralised organisation such as the government.

Crypto-friendly banks typically offer a wide range of services designed to meet the needs and requirements of crypto-related customers and businesses.

These services vary depending on the bank, and they include cryptocurrency exchange accounts, cryptocurrency-backed loans, and crypto payment processing. Some of the crypto payments that crypto-friendly banks support are conversions to fiat currency, crypto custody and cards linked to crypto holdings.

The main focus of top crypto banks is offering services that meet the unique needs and requirements of the cryptocurrency market. Most of these banks are at the forefront of invention in this ever-changing industry.

Best Crypto Friendly Banks

While some banks and financial institutions have added cryptocurrency to their range of traditional products since its increase in popularity, some were established specifically with blockchain technology in mind. Here is a list of the best crypto friendly banks in the world.

Revolut

With its establishment in early 2020, Revolut is one of the US and Europe’s newest and most modern financial institutions. The bank has an application that allows iOS and Android device users to purchase different cryptocurrencies.

Revolut customers can buy and exchange crypto anytime and from anywhere with this app. The application also allows its customers to utilise the auto exchange option that purchases cryptocurrency when a given exchange rate is attained.

Opening a Revolut account is free and straightforward and enables you to access early pay and own an FDIC-insured account. In its initial stage, the bank didn’t support crypto withdrawals, but currently, its customers can use Ledger and other wallets to do so.

Purchasing cryptocurrencies using Revolut attracts a 2.5% base fee, plus 0.5% if you trade more than £1000. If you upgrade to premium or metal accounts, you can be able to reduce this fee to 1.5%.

Revolut is making huge progress in the cryptocurrency world, but its fees are relatively higher compared to other banking institutions. One of its strongest points is that it doesn’t restrict crypto activities compared to other banks, so it might be considered best crypto bank.

Bankera

Bankera is an international financial institution providing digital solutions to businesses and individuals. It was established with a focus on digital assets and businesses. As a result, it accepts customers from different industries, including online gaming, peer-to-peer finance, electronic commerce, and affiliate marketing, among others.

Bankera is crypto-friendly, which means customers can send and receive fiat cash to and from crypto platforms and exchanges. If you want your regular bank account to connect directly to a crypto or exchange platform and manage transactions in digital and fiat currencies, Bankera is an ideal option.

The bank has an application that connects a crypto wallet and exchange. A Bankera account allows you to own a card, apply for business loans and enjoy instant and multi-currency payments. Bankera is known for its low charges and fees, which is one of its strongest points. It doesn’t charge monthly fees for personal accounts.

Bankera charges a 0.1% flat rate for SEPA transfers and 2.0% for crypto and ATM withdrawals. One of the perks that Bankera offers is that it supports some free crypto and ATM withdrawals per month, helping to offset some of the costs.

The bank offers an array of services designed to make the process of managing your funds easier, including invoicing tools, payroll services and payment processing. It also supports multi-currency accounts, ranging from digital to fiat. Bankera might be in contention for the best bank for crypto.

Monzo

Monzo is one of the top crypto friendly banks available to cryptocurrency enthusiasts. As a digital-only bank, it allows its customers to take full advantage of mobile banking. Similar to Bankera, Monzo is friendly in terms of transaction fees. It doesn’t charge fees for card payments, and the basic account is free.

Since its establishment in 2016, Monzo has been outstanding, and one reason that makes it popular as a crypto-friendly bank is that it continued to operate during the Binance crisis when other institutions stopped supporting cryptocurrency exchanges.

Its unique features include a salary sorter, savings pots, spending budgets, bills pots, free cash withdrawals abroad, instant payments and no transaction fees.

Barclays

Barclays Bank customers have the opportunity to invest in digital assets through a safe and compliant platform. By using an FCA-regulated and reliable crypto exchange, Barclays’ account owners can convert GBP, USD, Pound and any other currency to acquire crypto assets.

Barclays demonstrates a cryptocurrency-friendly approach but with the best restrictions in place to protect customers. Users can link their Barclays Bank accounts with FCA-licensed exchanges, ensuring compliance with the FCA regulations.

Barclays Bank has an up-and-down history with cryptocurrency, having partnered with Coinbase and then cancelling the agreement in 2019.

Despite this, the bank generally allows payments from and to crypto exchanges, but there have been some cases of declined payments and account closing due to fraud detection and control. But it has worked well for legit transactions.

Coinbase

Coinbase isn’t just an exchange platform; it offers some bank services to its customers. As a public firm that trades on the NASDAQ, it’s duly registered with the SEC, which means customers can trust it as much as they do with a regular bank.

Apart from institutional trustworthiness, Coinbase can also act as a regular bank since users can deposit funds in fiat currency to their cryptocurrency wallets and withdraw them.

While Coinbase doesn’t support interest accounts, it allows users to stake their cryptocurrencies via their digital wallets. Cryptocurrency staking could accumulate rewards similar or superior to regular interests on traditional bank accounts. Crypto staking with Coinbase is available on six tokens, including Algorand, Cardano, Cosmos, Ethereum, Dai and Tezos.

Coinbase charges a relatively higher fee for transactions compared to other banks. It charges approximately 3.99% on each cryptocurrency-based transaction. Customers who want to purchase or sell cryptocurrencies with fiat cash will also need to pay a fee of 1.49%.

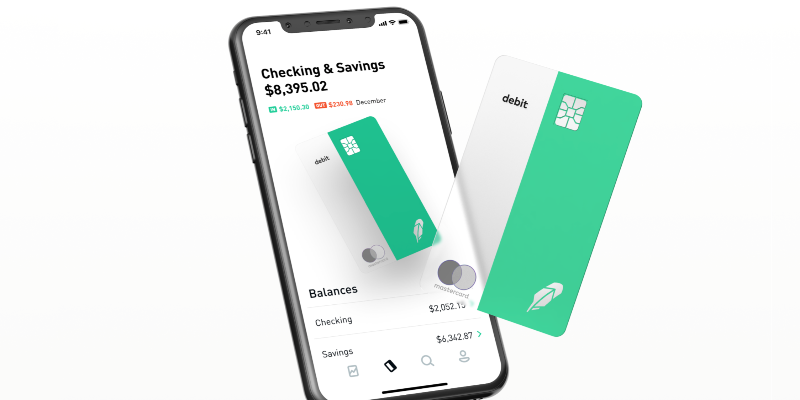

Robinhood

Robinhood is more of a brokerage, but money deposits have up to £250,000 in FDIC insurance and currently can generate up to 3% APY. That means it’s possible to set up direct deposits, earn cash and spend it through the Robinhood debit card. Robinhood yields numerous benefits of a cryptocurrency-friendly bank.

Sending money to a Robinhood brokerage account allows you to buy crypto and stocks. Crypto trading is straightforward, using idle money in Robinhood with very little wait period for settlement, making it arguably the best bank for crypto trading.

That means it’s possible to take your pick of crypto, such as USDC, SOL and BTC, among others and then withdraw immediately after one week.

You can send it to Robin hood crypto wallet or any other third-party platform, hardware wallet, or crypto exchange. You’ll accumulate a significant amount of interest if Robinhood puts your crypto funds on hold.

Conclusion

If you are a sports bettor or a gambler and crypto is your favourite currency, you need to find the best crypto friendly bank. While finding the right bank is a challenging task, the ones discussed above are undoubtedly the best in the industry. Most crypto friendly banks will provide crypto-tailored products and services to support cryptocurrency transactions to and from your sportsbook account.